Resources Top 4: St Barbara crystal balls 10-year vision for PNG gold mine; PEC still flexing

Mining

Mining

Here are some of the biggest resources winners in early trade, Friday May 10.

St Barbara (Babs for short, possibly (JC: St Barbs, for anyone who’s lived in the centre of the Universe (aka Kalgoorlie))) is a miner of decent size (circa $220m market cap) focused on gold mining exploits in both Canada and Papua New Guinea.

Formerly the owner of the Gwalia gold mine near Leonora until its debt-busting sale to Genesis Minerals (ASX:GMD) last year, the one time market darling has been looking for some good news to coax investors into letting it back into their hearts.

Finally, SBM’s share price is making good ground today after the company revealed its 10-year outlook for the Simberi mine in PNG.

The company’s crystal balling is the result of a recent ‘Expansion Concept Study’ it conducted that considered as many as six different options/outcomes.

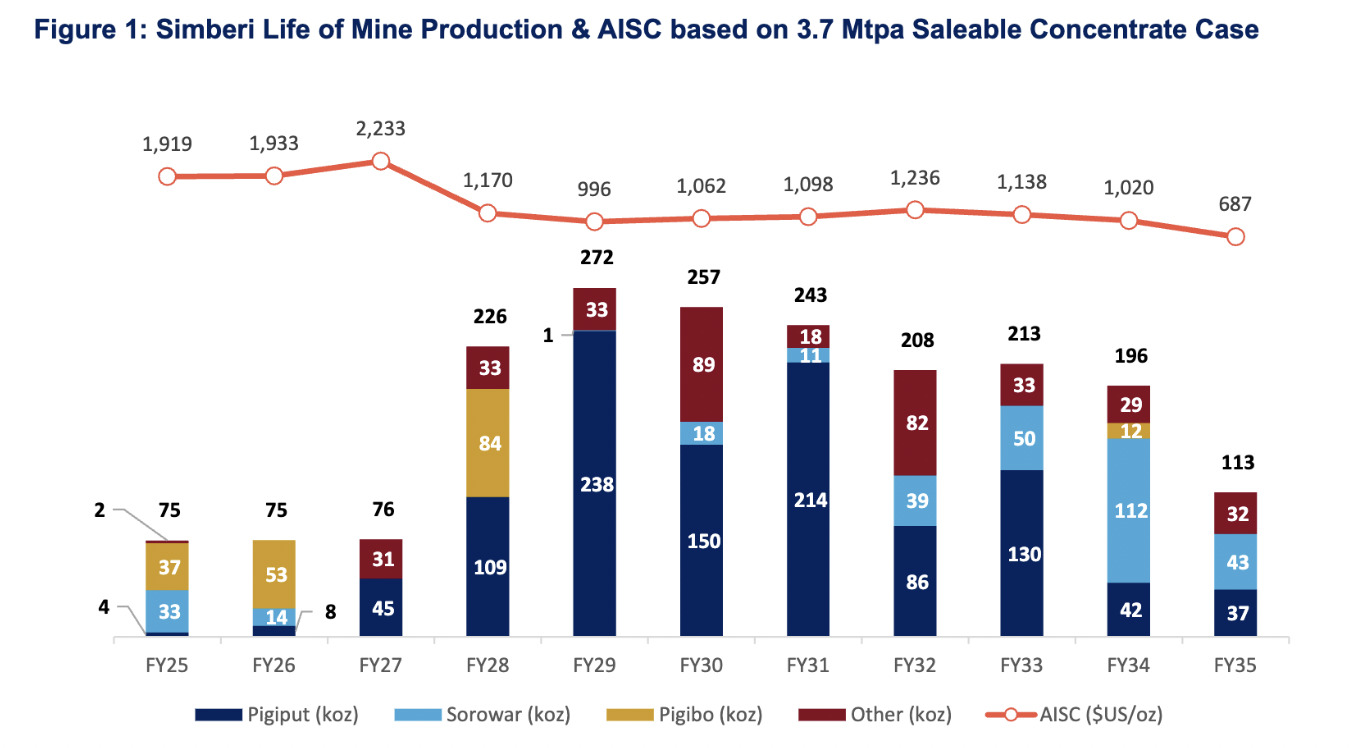

Takeaways for investors (assuming, that is, a 3.7Mtpa throughput rate):

• Total gold production of 2Moz

• Average annual gold production rising from 70,000 to 75,000oz in FY25 to FY27 to 230,000oz through to 2034; and,

• All-in Sustaining Costs decreasing to US$1,000-$1,200/oz from FY28 to FY34.

Significant expansion growth capital and pre-expansion growth capital and 8,000m+ of drilling has been proposed for 2025.

The company notes this model will see it focus on Simberi’s expansion as a priority ahead of its ill-fated Atlantic Gold Operations in Nova Scotia, Canada.

MD and CEO Andrew Strelein said the study “provides a strong case for St Barbara to push forward with the larger 3.7Mtpa throughput options at Simberi.

“We now have a road map we can pursue that can take us to increased, more profitable production at Simberi into the mid-2030s.”

Just recently, too, by the, way, St Barbara revealed a collaboration with a company called Stratum AI, in which the two are planning to boost SBM’s gold production in PNG through AI-driven algorithms to classify mineralisation.

(Up on yesterday’s news)

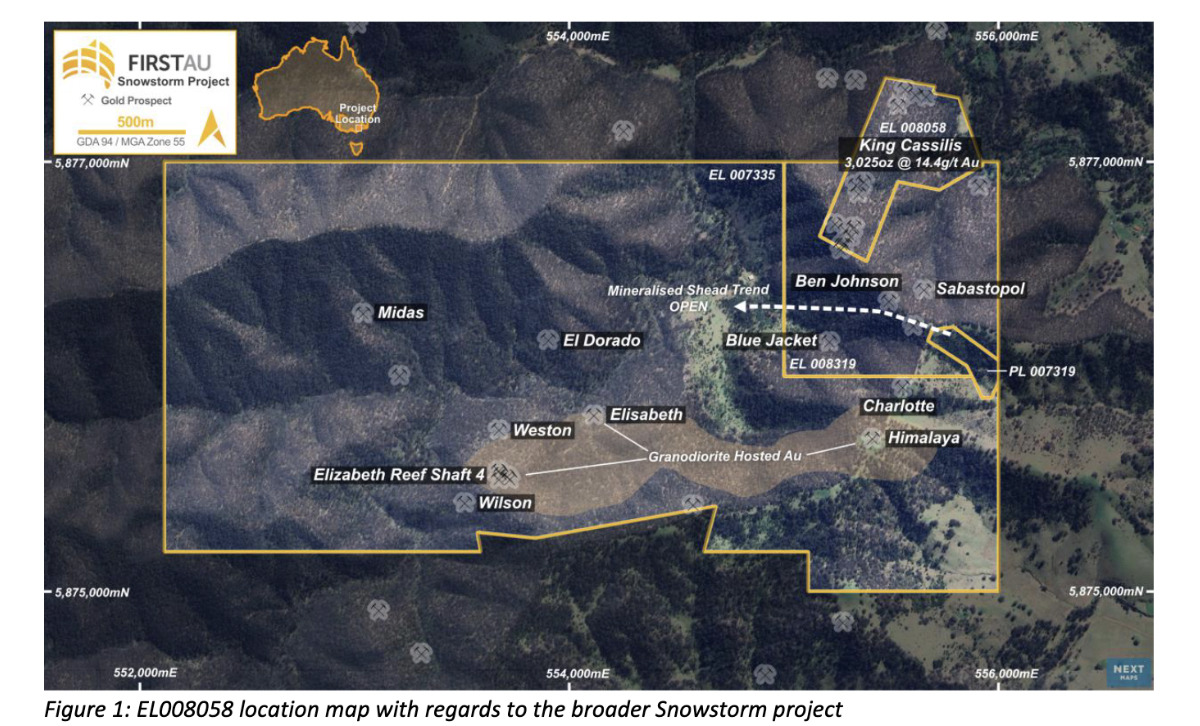

Gold hunter First Au revealed yesterday its new exploration lease EL008058 in Victoria includes the historical King Cassilis mine which, according to records, produced more than 3000oz of gold at a grade of 14.4g/t.

Investors in the minnow stock clearly enjoyed this, with the share price now notching a half century of percentage gain for the week so far.

The exploration lease has this week been granted by the Department of Energy, Environment and Climate Action of Victoria and is valid for five years – 90% owned by East Victoria Goldfields, which is a wholly owned subsidiary of First AU.

The new lease increases FAU’s footprint in what’s dubbed the ‘Snowstorm’ area (see below).

Company director and geologist Xavier Braud noted that “this tenement is a welcome addition to the portfolio of prospective gold projects in Eastern Victoria. The presence of the historical King Cassilis Mine is the proof of past high grade gold production in the area.”

(Up on yesterday’s news)

PEC is still flexing hard with a +20% gain at the time of writing.

We gave it a mention in this column yesterday, but Stockhead‘s Jess Cummins narrowed in on Brazil’s Lithium Valley activities (where PEC’s focus lies) and dug deeper with this article:

This ASX explorer is looking to drill new pasture inside Brazil’s booming Lithium Valley

Well worth a read, that, in which it covers nearology aspects of note (ie. Sigma Lithium’s Grota do Cirilo project and Lithium Ionic’s Banderia project) in relation to PEC’s newly acquired, 12,000 hectare ground, where it’s looking to kick off maiden drilling.

PEC, by the way, also operates the Beharra silica sand development project in WA about 300km north of Perth and yesterday we saw some news related to that.

Namely, a very healthy tax rebate from the Australian Government Department of Industry, Science and Resources, granting it an AusIndustry R&D tax incentive of $161,473.

The company says it’s in recognition of its “innovative processes undertaken to explore additional impurity reduction at the Beharra high grade silica sand project”.

The funds will be used to help advance the company’s various exploration projects.

(Up on news this week)

Earlier this week, this junior Queensland-based gold/copper/silver hunter and developer announced an eye-catching drilling result at its flagship Dittmer gold operation.

Stage 4 underground drilling has been underway at the central QLD prospect, and its most recent assay results have returned, among others, the following ‘bonanza’ highlights:

• 3m at 19.50 g/t gold from 88m including 1.2m at 48.25 g/t gold from 88.8m

• 3m at 16.97 g/t gold from 96m including 0.85m at 58.83 g/t gold from 97.35m; and,

• 5.1m at 7.07 g/t gold from 190.9m including 2.1m at 16.80 g/t gold from 190.9m and 0.3m at 89.96 g/t gold from 192.7m.

The company notes that its deeper holes at the prospect “continue to suggest that the lode structure is widening at depth” and confirms that the gold mineralisation remains open along strike and at depth.

Final assays for this round of drilling are expected later this month. Meanwhile, plans are now underway for initial surface drilling at Dittmer.

The company is convinced Dittmer is a major mineralised system defined by broad anomalies and has strong backing from mining investment firm Taurus.